-

Bahasa Indonesia

-

English

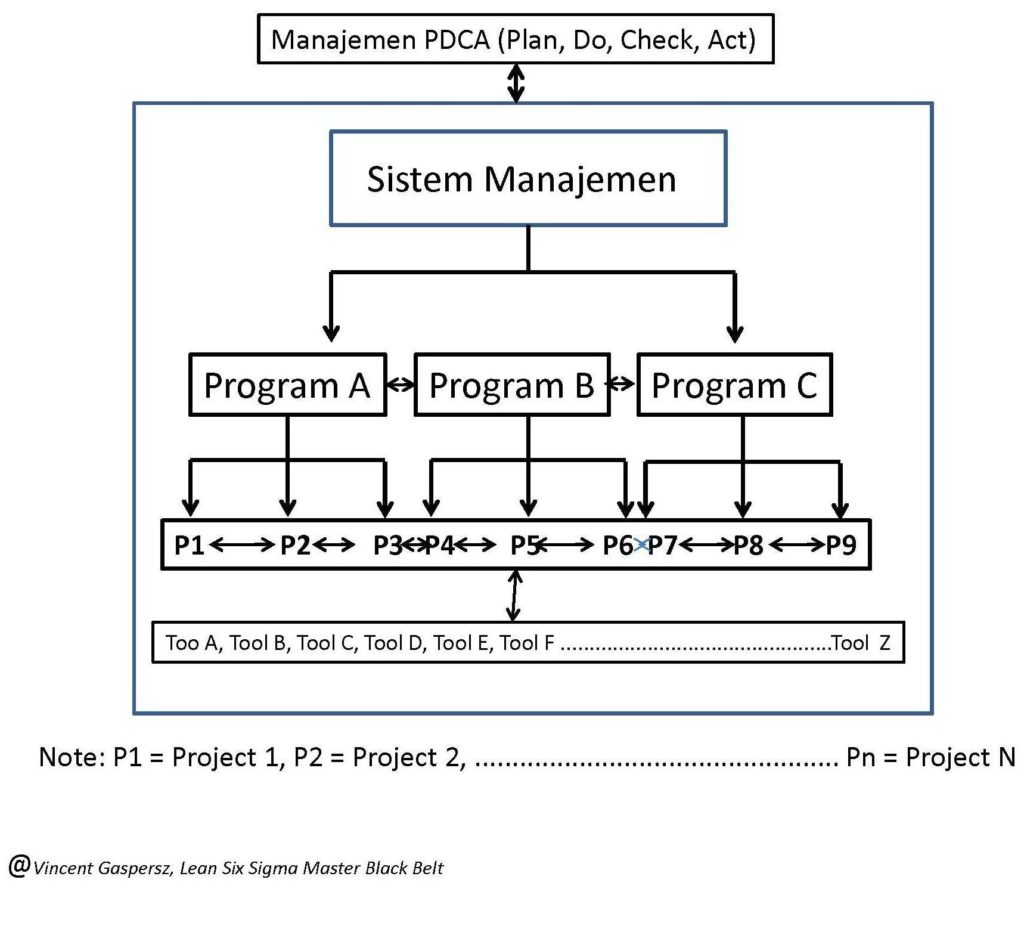

FAKTA berikut telah membantah pendapat asal bunyi TANPA disertai informasi dan analisis bahwa pelemahan rupiah akan meningkatkan daya saing produk ekspor Indonesia sehingga akan meningkatkan nilai EKSPOR Indonesia! Agar diketahui saja bahwa MANAJEMEN itu berdasarkan FAKTA dan ANALISIS bukan berdasarkan pendapat asal bunyi (ilmu omong-omong asal bunyi TANPA SOLUSI), sehingga peningkatan EKSPOR bukan asal ngomong TETAPI ada faktor-faktor atau variabel-variabel yang harus diukur, direncanakan, dilaksanakan, dikontrol, dan ditingkatkan terus-menerus dalam prinsip-prinsip MANAJEMEN PDCA = Plan, Do, Check, Act.

Di samping faktor kualitas dan harga produk manufaktur Indonesia yang tidak kompetitif di pasar internasional, ada beberapa faktor seperti: permintaan terhadap komoditas primer termasuk produk tambang (industri primer) yang menurun beserta harga yang anjlok, produk industri manufaktur Indonesia sulit memasuki pasar-pasar Eropa dan USA karena pembebanan tarif masuk yang tinggi, sehingga tidak kompetitif dari segi harga jual.

Kebijakan pemerintah Indonesia terbaru melalui peraturan Menteri Keuangan No. 132/PMK/010/2015 adalah menaikkan semua tarif bea masuk produk-produk impor barang konsumsi bervariasi dari 15% sampai 150%. Konsekuensi dari hal ini, maka harga-harga barang konsumsi impor akan naik. Bentuk proteksi semacam ini PASTI akan “dibalas” oleh negara-negara lain yang juga akan melindungi pasar domestik mereka.

Catatan: baca bahwa dengan peraturan menteri keuangan yang baru yang mengenakan tarif bea masuk barang-barang konsumsi mulai dari 15% – 150% PASTI akan menaikkan harga-harga barang konsumsi. Akan terjadi PHK di mana-mana karena kelesuan ekonomi. Memangnya daya beli masyarakat Indonesia yang mayoritas adalah pekerja itu tidak akan terpengaruh? Silakan BUKTIKAN hasil analisis dan prediksi saya dalam 6 bulan ke depan, bisa saja SALAH!. Mungkin dengan ngomong terus setiap waktu bahwa Indonesia PASTI LOLOS, TIDAK AKAN terkena DAMPAK NEGATIF bisa menambah keyakinan diri untuk SUCCESS melewati badai krisis ekonomi yang telah menjalar ke mana-mana di dunia itu.

Yang harus dikuatirkan dalam perekonomian Indonesia mendatang (minimum 6 bulan dari sekarang) adalah kemungkinan terjadi krisis ekonomi di Indonesia sebagai konsekuensi dari krisis ekonomi yang terjadi sekarang di China. Dua negara kuat yang telah terkena dampak negatif dari krisis ekonomi di China adalah Australia dan Canada.

Sulit membayangkan bahwa Indonesia tidak akan mengalami masalah ekonomi sebagai dampak negatif dari efek krisis ekonomi di China, mengingat transaksi perdagangan Indonesia – China mengambil porsi terbesar dalam ekspor non migas Indonesia. Jika pada tahun 2014 nilai ekspor non migas Indonesia ke China mencapai US$ 16,46 miliar, maka periode Jan – Jun 2015 nilai ekspor non migas Indonesia ke China baru mencapai US$ 6,65 miliar.

Jika kita melihat secara komprehensif bahwa perekonomian Indonesia yang mayoritas masih ditopang dari ekspor sekitar 24%, konsumsi domestik masyarakat sekitar 56%, dan konsumsi pemerintah sekitar 8%, serta kontribusi China terhadap ekspor non migas Indonesia sekitar 12%, maka bersiap-siap saja Indonesia menghadapi badai KRISIS EKONOMI yang akan segera terjadi mengikuti berbagai negara kuat seperti Australia, Canada, dll.

Semua pernyataan asal bunyi bahwa FUNDAMENTAL ekonomi Indonesia kuat, dll mudah-mudahan memperoleh MUJIZAT dari Tuhan agar Indonesia terbebas dari KRISIS EKONOMI dalam masa 6 – 12 bulan mendatang.

Analisis dan informasi berikut ditujukan kepada mereka yang TIDAK memahami permasalahan dalam dunia nyata industri manufaktur di Indonesia dan selalu mengeluarkan pernyataan TANPA FAKTA dan berdasarkan informasi yang akurat.

FAKTA menunjukkan bahwa pelemahan nilai rupiah TELAH meningkatkan biaya manufacturing (manufacturing cost) dari industri-industri manufaktur di Indonesia. Saya saat ini sedang “membedah” laporan keuangan dari satu perusahaan konglomerat besar dengan aset puluhan trilyun karena mengalami kerugian selama 6 bulan pertama di tahun 2015 ini. Analisis menunjukkan bahwa penjualan menurun sedangkan biaya manufakturing meningkat. Mengapa pelemahan rupiah TELAH meningkatkan biaya manufacturing? Karena kandungan impor dalam hal bahan baku dan bahan pembungkus masih tinggi dan itu adalah FAKTA bahwa industri-industri manufaktur di Indonesia MASIH menggunakan bahan baku impor sampai di atas 60%.

Agar dipahami bahwa rata-rata Cost of Good Sold (COGS) dari industri-industri manufaktur di Indonesia berkisar di angka 60% – 80% (tergantung efisiensi produksi) dan minimum 60% dari struktur biaya ini tergantung pada harga impor yang nota bene HARUS dibayar dalam USD (Dollar Amerika). Dengan demikian pernyataan bahwa pelemahan nilai rupiah akan menurunkan biaya manufactur (manufacturing cost) HANYA berlaku kalau kandungan bahan baku 100% berasal dari bumi Indonesia. TETAPI siapa yang bisa menunjukkan bahwa ada industri manufaktur di Indonesia yang TIDAK menggunakan bahan baku IMPOR secara minimum, katakanlah HANYA maksimum 20%?

Data Bank Mandiri tahun 2014 menunjukkan kandungan impor dari industri manufaktur di Indonesia bukannya menurun TETAPI meningkat dari 62% menjadi 68% selama lima tahun terakhir. Berarti ketergantungan akan bahan baku impor BUKAN membaik atau menurun TETAPI memburuk atau meningkat. Bahwa produk industri manufaktur Indonesia mengandalkan bahan baku lokal dari bumi Indonesia HANYA ada dalam khayalan saja!

Silakan download informasi dari Bank Mandiri berikut.

https://www.google.com/search?q=kandungan%20impor%20dari%20industri%20manufaktur%20masih%20tinggi&ie=utf-8&oe=utf-8

Bagi PRAKTISI industri manufaktur di Indonesia nilai rupiah yang berada di kisaran Rp. 9000-an sampai Rp. 10.000-an per USD baru bisa bersaing, sedangkan nilai rupiah saat ini telah berada di angka Rp. 13.350 per USD. Jika nilai rupiah ini terus-menerus melemah maka hampir 90% industri-industri manufaktur di Indonesia akan bangkrut!

Krisis ekonomi yang telah mulai melanda industri-industri manufaktur di Indonesia sejak Januari 2015 adalah menghantam dari dua sisi sekaligus, yaitu sisi supply and demand. Dari sisi supply ditandai dengan peningkatan biaya produksi yang lebih tinggi sekitar 30%-40% sedangkan dari sisi demand ditandai dengan penurunan daya beli masyarakat terhadap produk-produk industri manufaktur Indonesia sehingga penjualan menurun.

Krisis ekonomi memang biasanya bermula dari sektor-sektor produktif (industri primer, sekunder, dan tersier). Jika industri bangkrut atau menurun drastis, maka akan terjadi PHK secara besar-besaran. Konsekuensinya penganguran meningkat, daya beli masyarakat yang mayoritas bersumber dari hasil gaji/upah tenaga kerja akan menurun yang berakibat kontribusi dari sektor konsumsi masyarakat menurun. Jika ekspor juga menurun dan konsumsi masyarakat menurun, maka satu-satunya sumber penggerak ekonomi HANYA dari sektor konsumsi pemerintah yang hanya sekitar 8% itu dalam perekonomian Indonesia. Untuk pembiayaan pemerintah, maka pemerintah menambah HUTANG yang berakibat lagi terkuras devisa yang sangat besar. Perekonomian melambat, kemudian menurun, dan terjadilah KRISIS ekonomi bagi negara itu. Sangat RASIONAL hasil analisis berdasarkan FAKTA, BUKAN pernyataan asal-asalan yang menyenangkan hati!

Pemerintah telah tahu, hanya sebagai pejabat negara maka TIDAK BOLEH mengungkapkan keadaan yang sesungguhnya agar TIDAK menimbulkan kepanikan dan keresahan dalam masyarakat. Kita yang HARUS pandai-pandai mengantisipasi perekonomian keluarga/rumah tangga kita, agar HANYA berdampak kecil pada masalah finansial keluarga.

Apakah suka-sukanya pemerintah menetapkan kurs rupiah terhadap mata uang asing, terutama USD?

Ini faktor-faktor yang paling dominan yang mempengaruhi nilai tukar mata uang suatu negara dibandingkan mata uang negara lain. Jika mau menetapkan kurs rupiah Rp. 9.000 – Rp. 10.000 per USD, PERBAIKI dahulu variabel-variabel penentu itu.

http://www.seputarforex.com/artikel/forex/lihat.php?id=133671

Salam SUCCESS.

Indonesian Exporters Loses Momentum to Enjoy Weakening Rupiah’s Gain

The following FACT has disproved the merely-sounding opinion WITHOUT information and analysis that says the weakening rupiah would increase Indonesian products’ export competitiveness, which in turn would increase the value of Indonesian EXPORTS. Just to be known that MANAGEMENT is based on FACT and ANALYSIS not based on merely-sounding opinion (WITHOUT SOLUTION); thus, EXPORT increase is not just a talk, BUT there are factors or variables that must be measured, planned out, done, controlled, and improved continuously in MANAGEMENT principles of PDCA = Plan, Do, Check, Act.

Beside the quality factor and non-competitive prices of Indonesian manufactured products in the international market, there are other factors like: demands toward primary commodities, including quarry products (Indonesia’s primary industry), that have been declining as, the prices that have been falling, and the difficulties of Indonesian manufacturing industry’s products to penetrate the European and US markets due to high import tariffs; thus making them not competitive from the selling price stand point.

The latest Indonesian government’s policy through the Regulation of Minister of Finance No. 132/PMK/010/2015 is to increase all tariffs of imported consumer goods varyingly from 15% to 150%. Consequently, all imported consumer goods would certainly increase. This form of protectionism would DEFINITELY be “responded” by other countries that would also want to protect their domestic markets.

Note: read that with the latest regulation of minister of finance that implements import tariffs of consumer goods from 15% – 150% would DEFINITELY increase the prices of consumer goods. There would be layoffs everywhere due to economic downturn. Do you think the purchasing power of Indonesian people, who majoritily are workers, won’t be affected? Please VERIFY my analysis and prediction in the next 6 months; I could be WRONG!. Perhaps by keep talking everytime that Indonesia WOULD SURELY ESCAPE, WOULD NOT be NEGATIVELY IMPACTED could at least boost the confidence to SUCCESSFULLY pass through the storm of economic crisis that has spread everywhere around the world.

What must be worried in Indonesian economy in the future (minimum 6 months from now) is the possibility that economic crisis would happen in Indonesia as a consequence of the economic crisis that is currently happening in China. Two developed countries that have been negatively impacted by the economic crisis in China are Australia and Canada.

It is hard to imagine that Indonesia would not experience economic problem as a negative impact from the economic crisis in China, considering that Indonesia – China trade takes the biggest portion of Indonesia’s non-oil exports. If in 2014, the value of Indonesia’s non-oil exports to China reached US$ 16.46 billions, then for Jan – Jun 2015 period, Indonesia’s non-oil exports to China has only reached US$ 6.65 billions.

If we comprehensively see that Indonesian economy that majoritily is still supported from exports of about 24%, domestic consumptions of about 56%, and government consumptions of about 8%, as well as China’s contribution towards Indonesia’s non-oil exports of about 12%, then be ready for Indonesia to face the storm of ECONOMIC CRISIS that would happen soon following what had happened in other developed nations like Australia, Canada, etc.

All the merely-sounding statements, that state Indonesia’s economic FUNDAMENTAL is strong, etc., would hopefully receive MIRACLE from God so that Indonesia could escape the ECONOMIC CRISIS in the next 6 – 12 upcoming months.

The following analysis and information is aimed to those who DON’T understand the problem in the actual manufacturing industry in Indonesia and always issue statements WITHOUT FACT nor based on accurate information.

FACT shows that the weakening of rupiah HAS increased the manufacturing cost of manufacturing industries in Indonesia. At the moment, I am “dissecting” a financial statement of a large conglomerate company with assets of tens of trillions because it has experienced losses for the first 6 months in this year of 2015. The analysis shows that sales have declined whereas manufacturing costs have increased. Why HAS the weakening of rupiah increased the manufacturing costs? Because the import contents in raw and packaging materials are still high; and that is the FACT that manufacturing industries in Indonesia are STILL using imported raw materials even beyond 60%.

To be understood that the average Costs of Good Sold (COGS) of manufacturing industries in Indonesia range between 60% – 80% (depending on the production efficiency) and minimum 60% of this cost structure depend on the import price that MUST be paid in USD(American Dollar). Therefore, the statement that the weakening of rupiah will reduce the manufacturing cost ONLY applies if 100% of the raw materials’ contents come from the land of Indonesia. BUT who can ably show that there exists a manufacturing industry in Indonesia that DOESN’T use minimal IMPORTED raw materials’ content, say even ONLY 20% maximum?

Data from Bank Mandiri in 2014 shows that the import content from manufacturing industry in Indonesia is not declining, BUT increasing from 62% to 68% for the past five years. This means the dependence on imported raw materials ARE not improving or declining BUT are worsening or increasing. That Indonesia’s manufacturing industry relies on local raw materials from the land of Indonesia ONLY exists in the imagination!

Please download this following information from Bank Mandiri.

https://www.google.com/search?q=kandungan%20impor%20dari%20industri%20manufaktur%20masih%20tinggi&ie=utf-8&oe=utf-8

For manufacturing industry PRACTITIONERS in Indonesia, the value of rupiah at the level of Rp 9,000-ish to Rp 10,000-ish per USD can only then make them competitive; whereas the current value of rupiah has been at Rp 13,350 per USD. If this value of rupiah is continuously weakening then almost 90% of manufacturing industries in Indonesia would go bankrupt!

The economic crisis, that has begun to engulf the manufacturing industries in Indonesia since January 2015, hits both sides at once, which are the supply and demand sides. From supply side, it is marked with the higher increase in production costs of about 30%-40%, whereas from the demand side, it is marked with the decrease in Indonesian purchasing powers toward Indonesian manufacturing industry’s products that also contributes to the declining sales.

Economic crisis usually begins from the productive sectors (primary, secondary, and tertiary industries). If an industry went bankrupt or drastically declined, then there would be massive layoffs. Consequently, unemployment rate would rise and purchasing power of the people, who majoritily comes from the working wage/salary, would decrease so that the contribution from the consumption sector would also decrese. If exports also decline and consumptions too, then the only source of economic driver would ONLY be from the government consumptions, which is only about 8% in Indonesian economy. For government financing, then the government would add more DEBTS, which would heavily drain its foreign exchange reserves further. The economy slows down, then declines, and the economic CRISIS would happen in that country. It is very RATIONAL to have the result of analysis based on FACT, NOT merely-sounding feel-good statements!

Government have already known, as well as the government officials, that they CAN’T reveal the actual situation in order to NOT create panic and anxiety in the community. We are the ones who MUST intellgiently anticipate our family/household economy, so it would ONLY affect little on our family financial problem.

Can the government set rupiah’s exchange rate at whatever level towards foreign currencies, especially USD?

These are the most dominant factors that influence a country’s currency exchange rate compared to other countries’ currencies. If you want to set rupiah’s exchange rate at Rp 9,000 – Rp 10,000 per USD, firstly FIX those determinant variables.

http://www.seputarforex.com/artikel/forex/lihat.php?id=133671

Best Regards for SUCCESS.